How to Enroll

It only takes a few minutes to be on the path to health care coverage today.

If you need help getting started, fill out our pre-screening form to be connected to one of our Navigators.

Re-enrolling? Click here to start the re-enroll process.

Enrolling for the first time? Click here to start the enrollment process on your own.

When can I apply?

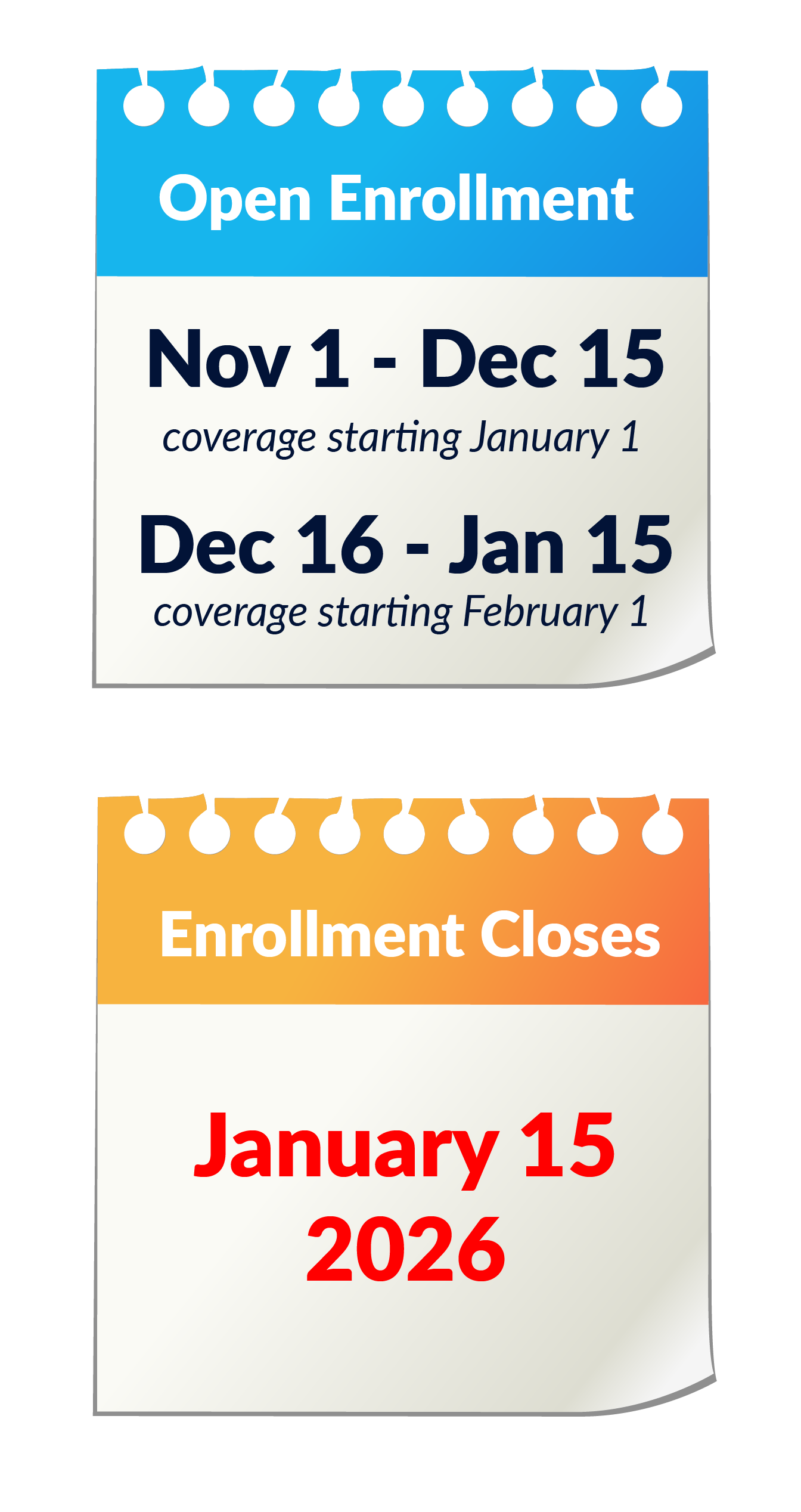

You can apply during Open Enrollment from November 1–December 15 for coverage that begins January 1 the following year. Open Enrollment completely closes January 15, 2026.

OR

You can apply today if you have had a qualifying life event within the last 60 days including: loss of coverage, birth of a child, marriage, or moved to a new state. If you have lost Medicaid, you have 90 days from loss of coverage to enroll.

If you are re-enrolling in the Marketplace, it's important that you complete your re-enrollment application by December 15. You must actively re-enroll this year, as plans and pricing are changing.

If you fail to re-enroll yourself, you could be auto-renewed into a plan or pricing that doesn't fit your needs.

Available Insurance

If you’re unsure which program fits your needs, completing the Marketplace application will automatically tell you whether you’re eligible for Medicaid, CHIP, or Marketplace subsidies before you see private plan options.

-

Income above your state’s Medicaid threshold but below 400 % of the Federal Poverty Level (FPL).

Eligible for Premium Tax Credits (PTC) and Cost-Sharing Reductions (CSRs) based on Modified Adjusted Gross Income (MAGI).

Compare private plans and receive financial help.

To qualify for subsidies, cannot be eligible for other types of health coverage (Employer offered coverage, Medicare, Medicaid, VA Coverage, etc.)

-

Your income falls at or below your state’s Medicaid limit for your household size.

You are pregnant and your income meets the higher Medicaid threshold for pregnancy.

A child (age 0–18) in your household qualifies under your state’s CHIP/Medicaid guidelines.

You may qualify regardless of whether you have other coverage options.

-

You have children under age 19 whose household income is too high for Medicaid but below the state’s CHIP limit.

You want low- or no-cost coverage specifically for eligible children.

You may still apply for Marketplace coverage separately if no adults in the household qualify for Medicaid.

What do I need to apply?

-

Full legal name, date of birth, and Social Security number (SSN) for every person in your taxable household that is applying for coverage.

Current mailing address and ZIP code.

Email address and phone number for notifications and follow-up.

-

Government-issued ID (driver’s license, state ID, or passport).

For non-citizens: Alien Registration Number, visa document, or other immigration paperwork.

-

Recent pay stub or most recent federal tax return.

-

Policy name, member ID, and effective dates for any existing coverage.

Medicaid/CHIP information (case number, state agency contact).

COBRA paperwork if you’re in a continuation plan.

-

Employer name and address (EIN if available).

Recent pay stub showing year-to-date earnings.

-

Proof of recent job loss or coverage termination (COBRA notice, letter from HR).

Marriage certificate, divorce decree, or birth/adoption records.

Lease agreement or utility bill if you moved outside your previous plan’s service area.

Official notice showing loss of Medicaid or CHIP eligibility (if applicable).

-

List of all current healthcare providers (primary care, specialists, mental health providers, etc.) with:

Provider name and specialty

List of all active prescriptions

Calculating Income

To learn more about what your income might qualify you for, complete the income calculator at www.healthcare.gov/income-calculator/.

It is very important that you accurately estimate your income. Your household income determines your eligibility for premium tax credits and cost-sharing reductions (CSRs). It must be reported as accurately as possible—if the estimate is too low, you may have to pay back subsidies when you file taxes next year; if it’s too high, you could miss out on savings you qualify for.

What’s Included as Income

-

Use your most recent pay stub to project annual earnings.

If paid hourly, multiply your hourly rate by expected annual hours.

-

Net profit (gross revenue minus business expenses) from your latest profit-and-loss statement.

-

Total amount you expect to receive this year.

-

Include both taxable and non-taxable social security. Use the full amount before any deductions.

-

Annual taxable amount from pension or annuity statements.

-

Net rental profit and any taxable dividends/interest.

-

Before January 1, 2019: Include alimony as income. You may deduct this as an expense.

On or after January 1, 2019: Don’t include alimony as income.

-

Capital gains, royalties, prizes, or any income reported on Schedule 1 of Form 1040.

Note: Do not include child support, SSI, non-taxable veteran’s benefits, workers’ compensation, or federal education grants—these are not counted toward MAGI.

We provide free, confidential, one-on-one guidance.

Please note that appointments are limited. Fill out our pre-screening form to get started.

CALL